Ever pondered long-term investment strategies, only to find yourself in a labyrinth of bewildering jargon and complex terms? Fear not, brave reader! Welcome to the adventure of demystifying investment instruments with a storytelling twist. 🚀 Imagine this as your intriguing tale that promises you financial success in the future kingdom of wealth. Grab your popcorn and prepare for an enlightening tour through the world of investments that are here to stay—effortlessly weaving humor, fun, and a truckload of glory!

Read More : Music Instrument Used In Ceremonies Celebrating Seasonal Harvests

Picture this: You’re stranded on a financial island with only one goal—return home with a fortune. The key to your rescue? Investment knowledge that’s not just solid, but golden. With our trusty list of long-term investment instruments, you’ll not only survive but thrive—all while singing tunes of prosperity. Let’s set sail and explore the secrets that could turn you into the Warren Buffett of your friend circle.

The Fundamentals of Long-Term Investments

Long-term investment plans are like planting trees; today’s saplings can morph into tomorrow’s mighty oaks. In this section, we unravel a list of long-term investment instruments that cater to novice and seasoned investors alike.

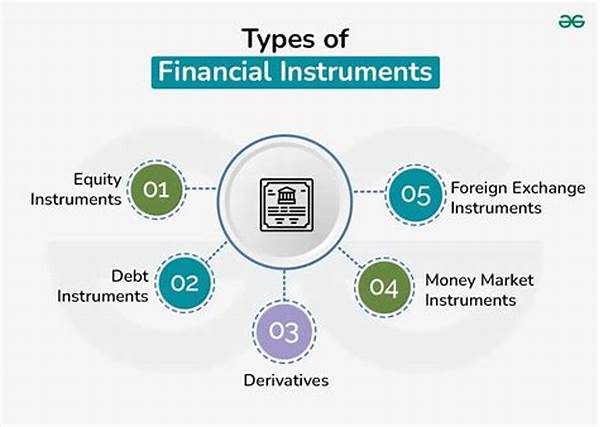

1. Stocks: Equities stand at the frontline of long-term investments. However, unlike blind dart throwing, stock investing requires research. Tip: Prioritize companies showing consistent growth and stable cash flows. Sure, the market fluctuates, but the right pick can ensure a whopping return over decades. 🎯

2. Bonds: Often dubbed safe harbors in the investment sea, bonds are loans you provide to corporates or governments, getting paid interest over time. They are ballet dancers in the world of investments, gracefully steady and risk-averse. 💃

3. Real Estate: Imagine owning a tangible piece of the world on your financial chessboard. Real estate offers lucrative returns with rental income and appreciation in property value. Pro tip: Location is key! 🏠

4. Mutual Funds and ETFs: If picking individual stocks feels like rocket science, mutual funds and ETFs are your commanding geeks. These pooled investments diversify across various assets, lowering risk. The cherry on the cake: professional management. 🍒

5. Retirement Accounts (401(k), IRAs): A future treat for current savings. Contributions are often tax-advantaged, gently compounding into a nest egg for those sunset years. It’s never too early to start retirement planning—dream big! ☀️

Exploring Diverse Investment Avenue

Venturing further along this journey, let’s dive into the unique offerings and features of these instruments—their purpose is as profound as their returns.

Stocks: The Equity Giants

Stocks are equity investments giving you ownership stakes in companies. As a shareholder, you partake in both profits and losses. Long-term stock investments can be highly lucrative, giving immense returns if invested wisely based on thorough analysis.

Read More : Recommended Electric Kalimba Instruments For Meditation Music Modern

Bonds: The Safe Keepers

Think of bonds as IOUs. They are less volatile than stocks, which makes them attractive for conservative investors. The potential downside isn’t zero risk, but they’re a stable cornerstone during volatile market tempos.

Real Estate: The Tangible Assets

Real estate investment requires an eye for locality, market trends, and potential growth. Choose wisely, and properties can yield residual income through rent and escalate in value over time, an ideal long-term treasure trove.

Mutual Funds and ETFs: The Diversifiers

Mutual funds and ETFs provide access to a basket of securities, reallocating investments to different sectors or asset classes. With professional management, you achieve diversification without mastering individual stock market intricacies.

Retirement Accounts: The Golden Years Vault

Tax benefits and structured growth potential make retirement accounts attractive and essential. They facilitate disciplined savings towards security and comfort in retirement years.

Detailed List of Long-Term Investment Instruments

Here’s a breakdown of our ultimate arsenal:

Key Points on Long-Term Investment Instruments

To succinctly summarize:

Rounding the Investment Conversation

In conclusion, long-term investments embody a compelling blend of strategy, patience, and selection. By utilizing the list of long-term investment instruments, you’ve enchanted avenues toward stable financial futures. Whether stocks dazzle or bonds comfort, the journey arms you with fiscal resilience. Start today, sow those seeds! 🌟