Welcome to the roller coaster of the financial world, where understanding money market instruments is the ticket to mastering short-term investments. Ever found yourself dreaming of a financial strategy that’s both stable and liquid, yet couldn’t place your finger on it? Money markets might just be your best-kept secret! While they may sound like jargon out of a finance textbook, these instruments are the cleverly crafted tools that can elevate your financial game, offering a playground for both novice and seasoned investors. But hold on, it’s not all business suits and serious faces; let’s explore these magic beans of finance with a sprinkle of humor and a dash of wit.

Read More : Plastic Filling Instrument Improving Patient Comfort During Treatments

Imagine a bustling, vibrant bazaar where short-term dreams are traded daily. Here, money market instruments take the stage, offering you the chance to balance risk and return, much like perfectly balancing an oversized pizza slice. They’re your financial quick-fix without the heartbreak of long-term commitments. Whether it’s been whispered in coffeehouse conversations or highlighted in economic news, understanding these instruments is crucial. So buckle up for this exhilarating ride as we unravel the mysteries of money market instruments, with a blogging flair and a pinch of marketing zest.

What are Money Market Instruments?

Understanding money market instruments and examples is crucial for efficient financial planning. In essence, these are short-term borrowing and lending instruments with maturity durations typically less than a year. Think of them as the agile ninjas of the finance world—swift, effective, and reliable. They provide businesses and governments quick access to liquidity while offering investors attractive risk-adjusted returns. From a storytelling perspective, they’re the underdog in theater plays that triumphs against the odds, offering stability in the ever-fluctuating world of finance.

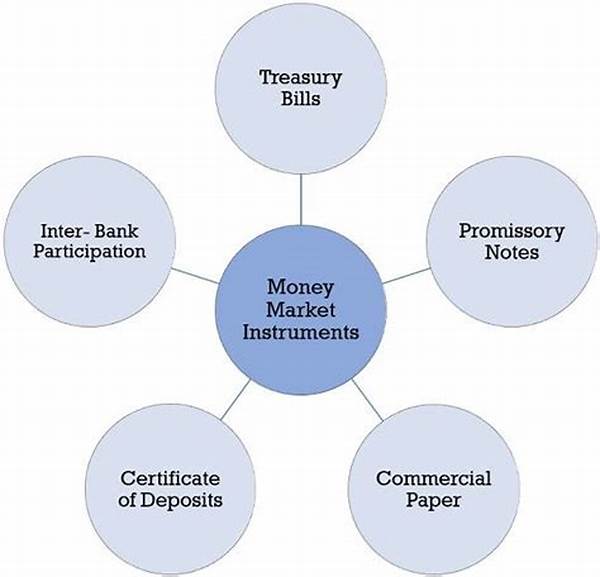

Types of Money Market Instruments

There are several key players in the money market, including Treasury bills, commercial papers, and certificates of deposits.

Treasury Bills

These are government-issued securities, often termed as T-bills, that promise assured returns within a specified short term. They’re akin to that comforting blanket on a rainy day—always reliable, with the government backing them.

Commercial Papers

Issued by large corporations, these unsecured promissory notes offer higher returns compared to T-bills. Picture them as high-risk, high-reward scenarios—akin to betting on your favorite underdog in a sports match, but with financial implications.

Certificates of Deposit

Banks issue these time deposits with specific maturity dates. They’re your grandma’s cookies, baked with love and care, promising value over time thanks to their fixed rate of interest.

The Appeal of Money Market Instruments

Why should you be interested in understanding money market instruments and examples? Well, it’s much like choosing the right app for mobile payments: convenience, efficiency, and security, all bundled into one. Engaging with these instruments offers diversification across your investment portfolio, placing you on a path to financial prosperity.

Safety and Liquidity

Money market instruments are typically low-risk assets due to their short maturities, making them highly liquid. They are the financial buffer that ensures an investor’s peace of mind.

Read More : Review Of Flamenco Guitar Instruments With Typical Spanish Wood

Attractive Returns

While the returns may not be stellar like stocks, they outshine regular savings accounts. They’re the dependable friend in an ensemble of investments that often save the day when the chips are down.

Practical Examples and Uses

Understanding money market instruments and examples aren’t just for accountants or financial wizards. Let’s break them down into bite-sized, relatable scenarios.

Conclusion: Ready to Dive into the Money Market?

Understanding money market instruments and examples is akin to owning a Swiss Army knife in your investment toolkit. These instruments offer remarkable benefits—liquidity, safety, and steady returns—while ensuring your financial aspirations aren’t just pipe dreams. They bridge the gap between long-term ambitions and short-term needs, offering a reliable option amidst fluctuating market sentiments.

Ultimately, if you seek to amplify your investment arsenal or are just curious about short-term financial maneuvers, diving into money markets is akin to discovering the secret ingredient to a flawless financial recipe. So, whether you’re a savvy investor or a finance rookie curious about expanding your knowledge, understanding these instruments is your gateway to crafting an astute financial strategy. The money market realm awaits your exploration; are you ready to take the plunge?

Summary Points to Remember

In the ever-evolving dance of financial decisions, understanding money market instruments can make you the lead performer, gracefully navigating through opportunities—and isn’t that the best finale one could hope for?