Welcome to the world of investing, where financial dreams take flight and savvy investors strategically navigate the vast expanse of opportunities to secure their future. If investing were like painting, your portfolio would be the masterpiece. But, how do you ensure it’s as vibrant and resilient as possible? Let me introduce you to the capital market instruments for portfolio diversification—a topic as engaging as it is crucial for achieving long-term investment success.

Read More : Chinese Traditional Music Instrument Guzheng Producing Graceful Melodies

In today’s rapidly shifting economic landscape, just about everyone is talking about capital markets. Whether you’re a newbie keen on learning the ropes, a seasoned investor sharpening your arsenal, or even a financial aficionado craving depth, diving deep into capital market instruments can be your ticket to mastering the art of diversification. Diversification, a concept as important as salt to a chef, ensures your investment eggs aren’t all in one basket—minimizing risks while maximizing potential returns. So, get ready, as we unravel the secrets of these financial instruments, wrapped neatly in humor, stories, and expert insights.

Understanding Capital Market Instruments

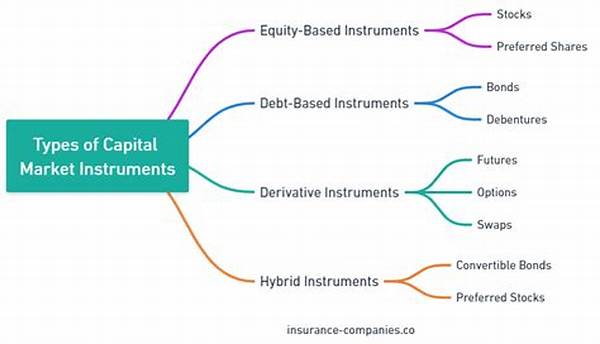

Capital markets offer a plethora of instruments, each designed to serve specific investment goals and risk appetites. These instruments are vital tools that investors use to diversify their portfolios and potentially bolster returns.

The Foundation of Portfolio Diversification

Capital markets provide a wide array of instruments such as equities, bonds, mutual funds, and derivatives. Equities represent ownership in companies and, typically, hold the promise of high returns, albeit with higher risks. Bonds, on the other hand, are less volatile, providing steady, albeit smaller, income streams by lending money to governments or corporations.

Exploring Different Types of Instruments

Diversification doesn’t just stop at selecting different asset classes. Within each class, there’s a world of variety. Mutual funds, for instance, can be equity-based, debt-focused, or balanced, catering to different risk profiles and return expectations. Meanwhile, exchange-traded funds (ETFs) offer a hybrid approach, mimicking the performance of an index while being traded like stocks.

Role of Derivatives in Diversification

Derivatives, like options and futures, are often seen as sophisticated instruments for adept investors. They provide leverage and risk management, allowing investors to capitalize on market movements without owning the underlying asset.

Capital market instruments for portfolio diversification not only cater to risk aversion but also allow for strategic plays to enhance returns, limit losses, and protect gains. It’s all about crafting a portfolio that mirrors both your tolerance for risk and your aspirations for growth.

Details and Objectives of Capital Market Diversification

The strategy behind utilizing capital market instruments for portfolio diversification is deeply rooted in the principles of risk management and potential return optimization. Here’s a closer look:

Global events like the 2008 financial crisis and the COVID-19 pandemic have demonstrated the importance of a diversified portfolio. Investors who wisely employed these instruments were better positioned to weather such storms, proving diversification’s efficacy in real-world scenarios.

Leveraging Capital Market Instruments: Pointers for Investors

When pondering which capital market instruments for portfolio diversification might fit your investment profile, consider the following strategies:

1. Understand Your Risk Tolerance: Know how much risk you can handle. Are you more of a daredevil or a sideline enthusiast when it comes to risk?

2. Set Clear Investment Goals: Align your choice of instruments with your financial aspirations, whether it’s retirement, children’s education, or that dream vacation.

Read More : Best Instrument Indonesia Tifa Drums Showcasing Papuan Traditions

3. Consult Financial Experts: When in doubt, seek advice from investment advisors who can provide personalized strategies for your portfolio.

4. Stay Informed: Keep abreast of market trends and economic indicators that can impact your investments’ performance.

5. Regularly Rebalance Your Portfolio: Adjust your investment mix to stay aligned with changing market conditions and personal goals.

Ultimately, it’s about crafting a portfolio that strikes a balance between risk and return, allowing you to sleep peacefully at night, knowing your investments are not only safe but are also working hard for you.

The Final Word on Diversification with Capital Market Instruments

Capital market instruments for portfolio diversification are your ticket to creating a robust investment strategy that hedges against risk while seeking growth. By spreading investments across different instruments, regions, sectors, and tenures, you effectively cushion your portfolio against unforeseen market gyrations.

Why Diversification Matters

Amidst market volatility, a diversified portfolio shines as a beacon of stability, which is precisely why seasoned investors swear by it. It’s akin to enjoying a buffet spread—where flavor, variety, and satisfaction are guaranteed, unlike sticking to a monotonous diet.

Success Stories Fueling Diversification

Consider the tales of investors who weathered storms like the tech bubble burst, or the more recent global economic shifts. Those with varied portfolios often emerged with fewer scars, demonstrating that diversification isn’t just a strategy—it’s a lifeline.

Embrace the vast, dynamic world of capital market instruments for portfolio diversification. It’s not merely about avoiding risks; it’s about crafting a financially secure and prosperous future. Whether you’re a novice or an old hand in investing, leveraging these tools can unlock a realm of opportunities, paving the way for your investment aspirations to take flight.