Corporate debt instruments in Indonesia are a captivating subject, not just for financial analysts and investors but also for anyone interested in understanding how companies fund their operations and expansion. Imagine standing on the bustling streets of Jakarta, skyscrapers towering above; these giants of industry do not rise on imagination alone. They need capital, and one of the most strategic methods they use is through corporate debt instruments. So, what’s the deal with these financial tools, and why does anybody care? Whether you’re a budding entrepreneur looking for growth strategies or an investor seeking new opportunities, understanding corporate debt instruments in Indonesia might be your golden ticket.

Read More : Organ Musical Instrument With Legendary Status Among Classical Musicians

Let’s uncover the layers of this intriguing financial phenomenon. For businesses in Indonesia, corporate debt instruments offer a way to obtain funds without diluting ownership. But it’s not just business executives who should care; these instruments also represent a tapestry of opportunities for investors looking for steady returns. Are you intrigued yet? You should be, because we’re about to unveil how these financial products not only fuel the nation’s economic engine but also create ripples of wealth that can touch you, the everyday investor.

Understanding Corporate Debt Instruments in Indonesia

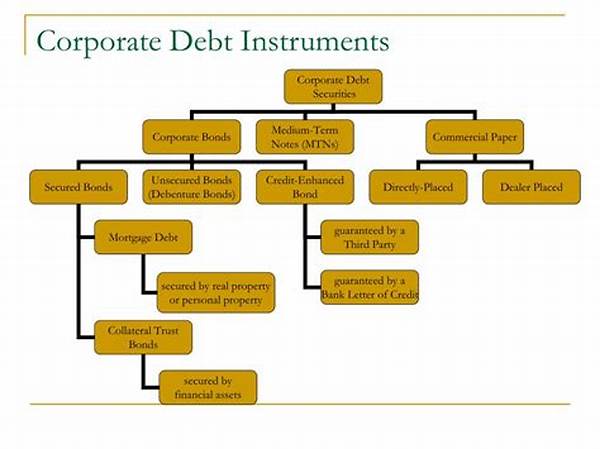

What exactly are corporate debt instruments in Indonesia? Simply put, they are tools used by companies to raise capital by borrowing. This borrowing can take various forms, such as bonds, debentures, and commercial paper. Companies issue these instruments to finance ongoing operations, capital projects, or to refinance existing debt. In Indonesia, where economic growth is consistently robust, and the business landscape is dynamic, the utilization of corporate debt instruments is increasingly significant.

Economic statistics reveal that corporate bond issuance in Indonesia has soared over the past decade, demonstrating a rising trend among local and multinational companies operating within the country. However, the intricacies of these instruments go beyond face value returns. For those who dare to dig deeper, there lies an opportunity for strategic investment and potential wealth accumulation. But how do these instruments really work?

Corporate bonds, for instance, involve a contractual obligation wherein the issuer must pay interest at specified intervals and return the principal at maturity. In essence, purchasing corporate debt instruments is an act of lending money to a corporation with the expectation of receiving regular coupon payments. Sounds like a win-win scenario if all goes well, right? But hold on, because there’s more to the story.

Types of Corporate Debt Instruments

Breaking it down further, corporate debt instruments in Indonesia can be categorized into several types. Each type presents a unique risk-return profile, catering to different investor appetites. Let’s explore some of these:

Each type carries its own set of opportunities and risks, which means due diligence is a must before investing.

Investment Opportunities in Indonesian Corporate Debt

With a profound understanding of what corporate debt instruments encompass, it’s time to look at why they are compelling investment opportunities. Investors aim for corporate debt because of the relatively higher interest rates compared to government bonds and the diverse issuer profiles that enhance portfolio diversification.

Consider a testimonial from Adi, a local investor: “Investing in corporate bonds has allowed me to diversify my portfolio while gaining better returns than traditional savings accounts or government securities. It’s about strategic choices that align with financial goals.”

Read More : Ophthalmology Instruments For Eye Examinations

To maximize benefits, investors in Indonesia should engage in meticulous research, evaluating not just interest rates but also issuer credibility and market conditions. Smart investors often find themselves navigating the corporate debt waters with the guidance of seasoned financial advisors, ensuring they avoid pitfalls and embezzle their nests with gold.

Detailing Corporate Debt Instruments in Indonesia

To elaborate further on these instruments, let us discuss their operational efficiency and market presence.

The Impact of Corporate Debt on Indonesian Economy

One cannot ignore the broader economic impact of corporate debt instruments in Indonesia. They play a pivotal role in capital formation and economic development. Companies can fund expansion projects, enhancing productivity, creating jobs, and ultimately driving national growth. In this context, corporate debt is not merely a financial tool but a vital part of Indonesia’s economic fabric.

Conclusion: The Future of Corporate Debt Instruments

As we encapsulate this exploration, it’s clear that corporate debt instruments in Indonesia are more than mere financial contracts. They embody growth, opportunity, and strategic depth. With regulatory advancements and economic progress, the landscape for corporate debt instruments continues to evolve. Investors and corporations alike must stay informed and adaptive to harness the full potential of this financial dynamo.

Heeding the whispers of economists and the successes of seasoned investors, the future of corporate debt instruments in Indonesia shines bright. Whether you’re a business mogul, financial analyst, or an individual investor, the call to action is clear: Dive in, explore, and leverage these instruments for unique economic enrichment.