Imagine yourself at a bustling marketplace, with options as far as the eye can see. You’re there to make an investment, a choice that could shape your future. Among the cacophony of voices, two terms linger persistently in the air – stocks and bonds. As you navigate the aisles of investment opportunities, understanding the unique differences between these two can be just as thrilling as a midnight pizza run with friends. It’s not just about making money; it’s about knowing what your money is doing out there in the financial world.

Read More : Organ Musical Instrument Producing Majestic Sounds For Sacred Rituals

Let’s demystify this financial conundrum. Think of stocks and bonds as two contrasting personalities at a party, each vying for your attention. Stocks are like that exuberant, high-energy friend who promises excitement and potentially great rewards – but alas, is slightly unpredictable. Meanwhile, bonds are the reliable, steady companion whose social media stories might not be headline-grabbing but have a charm of their own in the long haul. Springing to life, both demand your attention, yet each calls for a distinct approach. So, which one gets your attention, and more importantly, your investment? Dive in as we unravel the enthralling differences between stocks and bonds, making sure your financial journey is both exhilarating and enlightening.

Understanding the Basics: Stocks vs. Bonds

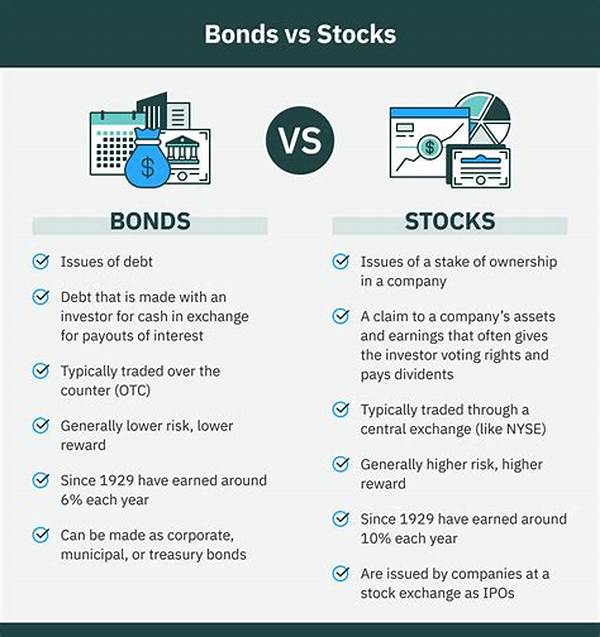

At the core of investment lies a simple question — what do you get when you buy a stock or a bond? Buying stocks, or equity investments, means you essentially own a small piece of a company. Think of it as owning a slice of that delicious pie you crave. The size of your slice grows if the company does well, often reflecting in the form of dividends or an increase in stock value. Oh, the sweet promise of a flourishing company!

On the other hand, bonds are akin to lending money to your reliable uncle who always pays you back, with an extra gift for the favor. Here, you essentially lend money to an entity, like a corporation or government, and they promise to pay you back with interest. The focus remains on earning regular income, often with lower risk involved compared to the roller-coaster ride of stock investments.

Risks and Rewards

But wait! Isn’t risk just another word for excitement? In the investment realm, stocks historically offer higher returns but with higher volatility. Imagine a roller-coaster with thrilling highs and occasional gut-wrenching drops. For an investor, this could mean significant profits or potential losses depending on the market’s fickleness.

Conversely, bonds are the gentle cruise along a calm river. The returns might not be as high as stocks, but the stability they offer can be immensely comforting. Bonds provide consistent income through interest payments, serving as a cushion against the market’s wild swings, making it ideal for those who cherish financial stability.

Goals and Investment Strategies

Behind every investment decision, there’s a goal. Are you seeking rapid wealth accumulation or a steady income stream? If you’re after quick and potentially large gains, stocks might be your game. The adrenaline rush is real as market trends favor companies you’re backing. However, this isn’t about reckless speculation; hence, gaining market insights and staying informed are your trusted companions.

If the idea of safeguarding your wealth with gradual growth appeals, bonds could be your trusted ally. Life’s uncertainties demand stability, with bonds acting as the ballast in the turbulent sea. As you align your objectives, the differences between stocks and bonds become evident, aiding in crafting a meticulously balanced portfolio.

Diversification: The Balanced Dance

Wise investors know not to place all eggs in one basket. Leveraging both stocks and bonds within a portfolio can effectively mitigate risks while maximizing profits. It’s like dressing up for winter and summer simultaneously, ensuring you’re prepared for all seasons. Balancing these assets is crucial, creating a diversified portfolio that leverages the strengths and minimizes the weaknesses of both investment types.

The Definitions and Ideal Scenarios

Here, let’s chart out a little framework for the eager minds on the hunt for knowledge about stocks and bonds.

Stocks:

Bonds:

Read More : Music Instrument Reshaping The Sound Of Hybrid Music Ensembles

Picture this – investing in stocks is like the thrill of an end-of-season sale, while bonds represent the calm assurance of a fixed deposit. The differences between stocks and bonds continue to draw in varying personality types, each tailored to fit different comfort levels and financial aspirations.

A Closer Look at Investment Pros and Cons

Consider the individual features and advantages of these investment types through the lens of an educated investor:

Stocks:

Bonds:

Concluding Thoughts: Navigating Financial Terrains

Venturing into the world of investments is an exciting yet intimidating realm, often leaving participants with a cocktail of emotions. But fear not, understanding the differences between stocks and bonds is akin to mastering the tango and waltz – both equally captivating but distinct in rhythm.

Final Insights into Stocks and Bonds

Reflect on testimonials, history of market analysis, and case studies as your personal guides in making these decisions. Some investors relate to the thrilling narratives of stock market triumphs, while others cherish the steady development bonds offer. Carefully evaluating personal objectives, risk tolerance, and market knowledge, ensures a portfolio tailored to both ambitions and limitations.

No longer should the terms stocks and bonds incite confusion. Smile at their mysteries with newfound comprehension, allowing for informed decisions, and ultimately shaping a future as delightful as Sunday brunches. Carry forth this insider knowledge, strategically cultivating your financial garden with both these classic investments. Harvest the rewards, painting your financial landscape both creatively and effectively.