Have you ever wondered how businesses manage risk in the volatile world of commodities and assets? Or how investors speculate on the future value of these assets with limited initial investment? Welcome to the fascinating world of futures contract derivative instruments. This realm might sound complex, but worry not—it’s full of enticing opportunities, financial strategies, and, believe it or not, humor. Imagine the thrill of predicting the market’s future or the satisfaction when your seemingly speculative bet turns profitable. With futures contracts, excitement and finance go hand in hand.

Read More : Indonesia Traditional Music Instrument Tifa Drum Leading Papuan Dances

Now, you might be imagining seasoned traders staring at multiple screens filled with cryptic charts. However, futures trading isn’t as exclusive as it used to be. Nowadays, with a click, everyone from part-time bloggers to seasoned journalists can engage in this high-stakes game. The best part? You don’t need a degree from Harvard to start. This space offers both a unique learning curve and a humorous journey. So, buckle up as we delve deeper into “examples of futures contract derivative instruments” and unveil how you, yes you, might be able to navigate and thrive in this electrifying world!

Understanding Futures Contracts

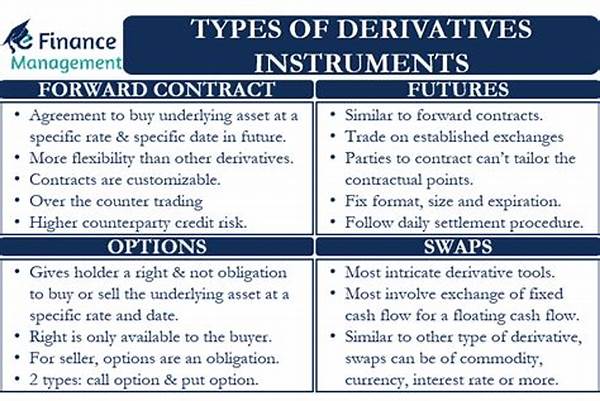

At its core, a futures contract is a standardized agreement between two parties to buy or sell a particular asset at a predetermined price at a specified time in the future. This might seem straightforward, but the applications are vast and include commodities like oil, agricultural products, and financial assets such as indices and currencies. The allure of futures contracts lies in their ability to hedge against price fluctuations and provide substantial returns on investments due to their leveraged nature.

One might wonder, “How do these contracts truly work in practice?” Suppose you’re a farmer who anticipates harvesting corn in three months. The current market price of corn is favorable, but there’s a chance that prices might plummet before your harvest reaches the market. By entering into a futures contract, you can lock in the current price, ensuring that no market volatility will affect your expected revenue. On the flip side, an investor believes the price of corn will rise and enters into a contract betting on that future price, aiming to sell at a profit.

Why Invest in Futures?

Futures contracts are not just for corporations mitigating risk. They offer unique opportunities for individual investors and traders looking to speculate. If you possess the analytical skills to predict market trends, you can profit significantly by buying futures contracts at low prices and selling them when prices rise. The leverage provided by futures intersperse added risk but promises high returns—making it both a thrilling and educational journey.

The trading world is ripe with stories of both incredible successes and surprising failures in futures trading. Take the story of a group of novice traders who, with just an insightful tip, managed to outsmart market experts and generate substantial returns overnight. While not a regular occurrence, these tales serve as intriguing testimonials to the potential of futures investments.

Examples of Futures Contract Derivative Instruments

Commodity Futures: These are probably the most well-known examples of futures contracts. They involve raw materials like gold, oil, wheat, and coffee. Investors can use these contracts to predict future prices and profitability of these resources. Don’t we all dream of sipping metaphorical coffee as the price of actual coffee skyrockets on the commodities market?Financial Futures: This type involves financial instruments such as currency pairs and interest rates. For instance, if you suspect the Euro will strengthen against the Dollar, you can secure a futures contract. This enables investors to hedge against international exposure or gamble on currency movements with significant leverage.

Real-world Implementation

The real-world impact of futures trading is immense—take airlines, for example. They often use oil futures to stabilize their fuel costs, ensuring they won’t face skyrocketing operational expenses with sudden oil price spikes. Similarly, multinational corporations employ currency futures to manage risks associated with forex fluctuations and maintain expected profit margins regardless of volatile market conditions.

Read More : The Best Recording Instruments For The Home Studio In 2025

Moreover, futures instruments allow for creative marketing strategies. Retail brands might fix prices on essential commodities to avoid transferring abrupt cost increases to consumers, thereby maintaining brand loyalty and customer satisfaction.

Detailed Overview of Futures Contract Examples

Perks of Utilizing Futures Contracts

The landscape of futures trading is vast, with each instrument serving distinct purposes. Investing in futures offers:

Common Pitfalls and Strategies

While the journey can be rewarding, it’s important to recognize and navigate the pitfalls that come with futures trading. Lack of research, over-leverage, and emotional trading can lead to significant losses. Implementing features such as stop-loss orders and maintaining a disciplined strategy can be effective safeguards for budding traders.

Conclusion: The Thrill and Strategy in Futures Trading

Entering the futures market feels like tiptoeing into an elite club of finance enthusiasts—it’s strategic, exhilarating, and can be incredibly rewarding. Companies and individual investors alike exploit these instruments to hedge against unforeseen risks and capitalize on potential market upticks. Whether you’re a farmer, trader, or a curious blogger, the appeal of futures trading extends beyond mere profit; it’s the intrigue of prediction, strategy, and occasionally, a deep sigh of triumph.

While risks are inherent, futures contracts offer a compelling way for young adventurers and seasoned investors to ride the waves of global financial markets. With each futures contract offering a narrative of market sentiment and strategic foresight, you’ll soon find yourself narrating your own success story in the fascinating annals of trade and investment.