If you’ve ever found yourself wondering why your morning coffee costs more today than it did last year, you’re not alone. Welcome to the world of inflation, where your purchasing power takes a slow yet steady dive every time prices rise. But while inflation may leave you grumbling over the price of your latte, its reach extends far beyond coffee shops and grocery stores. Indeed, inflation can cause ripples across financial markets, transforming how we interact with financial instruments in ways both expected and surprising.

Read More : Indonesia Traditional Music Instrument Kolintang Resonating From North Sulawesi

Imagine sitting in a cozy corner café and hearing a group of investors groaning about inflation over their espressos. As a fly on the wall, you might find the conversation riddled with financial jargon, but at the heart of it lies a compelling phenomenon that affects us all. Inflation isn’t just an economic buzzword used to amp up financial news discussions; it’s a defining factor in the performance of financial instruments. So, let’s pull back the curtain and delve into how inflation can turn the world of financial instruments on its head.

Understanding Inflation and Its Impact

The Basics of Inflation

Inflation refers to the rate at which the general level of prices for goods and services rises, eroding purchasing power. Sometimes depicted as the villain in the narrative of economic stability, inflation can actually play multiple roles. A modest level stimulates economic growth, while extraordinary levels can dampen economic aspirations, especially when they infiltrate financial assets.

How Inflation Affects Financial Instruments

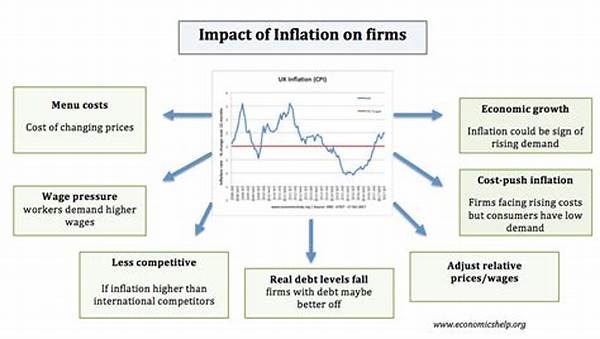

Inflation’s influence on financial instruments can resemble a domino effect. When inflation inches upward, interest rates are often modified to compensate for the decreased purchasing power. This, in turn, influences bonds, where yields may increase, and prices typically drop. Equities are another player, with companies needing to strategize on cost control and pricing policies. A stock market that thrives in an inflation-free environment might falter when inflation spikes.

Meanwhile, tangible assets such as real estate frequently receive a boost, as they’re seen as a hedge against inflation. Commodities often mirror this trend, with prices spiking. Suddenly, a simple discussion over coffee turns into a lesson in economic strategy, where understanding the effect of inflation on financial instruments becomes pivotal for investors.

Diving Deeper into Financial Instruments

Bonds and Inflation

Bonds, particularly government securities, are sensitive to inflation or its anticipated changes since they promise a fixed income over time. With higher inflation expectations, the real return shrinks, making existing bonds less attractive unless they offer inflation-protected securities, like Treasury Inflation-Protected Securities (TIPS). Suddenly, bondholder conversations at our hypothetical café may shift from cappuccinos to coping strategies.

Equities’ Love-Hate Relationship with Inflation

Stocks might call for celebration or lament during periods of inflation. Companies with robust pricing power can thrive by transferring costs to consumers. Yet, those with labor-intensive models might find themselves in a quagmire, experiencing higher expenses without equivalent sales boosts.

Read More : Science Instruments For Middle School Students

Strategies to Mitigate Inflation’s Impact

Real Assets: A Safe Harbor

Bonds with Built-in Protection

Diversification Across Asset Classes

Real-World Examples and Detailed Insights

Understanding the nuances of inflation’s impact can be simplified with tangible examples. Consider the following to bridge the abstract with the real:

Wrap-Up and Actionable Insights

Navigating inflation’s choppy waters necessitates a touch of creativity and strategy. Think of the role-playing investor, poised to tweak portfolios and stay agile amidst changing tides. Recognizing patterns and employing protective measures can safeguard investments while capturing growth opportunities.

In the end, taming inflation’s potential stressors comes down to being informed, agile, and ready to mix things up. Like our espresso-sipping investor, your approach need not be solemn; an informed, humorous outlook can elicit both wealth and wisdom in times of economic uncertainty.

Final Takeaways on Inflation’s Reach

Inflation, the notorious economic chameleon, dons many guises. Each disguise prompts varying responses among financial instruments. By staying educated and flexible, you can weather these shifts with finesse and maybe even a smile—just like the investor who finds humor in recalling how even a priced-up espresso can offer insights into economic strategy. After all, a well-blended approach brews success, keeping portfolios steaming and spirits high.